ConocoPhillips beat analysts’ first quarter earnings estimates handily thanks in large part to record oil and gas production. The company reported an adjusted EPS of $3.27 versus 69¢ in the year ago quarter, and the $3.17 expected by analysts. Crude oil production topped 915 million barrels of oil a day. Natural gas production rose to 3.2 billion cubic feet per day. The company also announced a boost to its capital return program to $10 billion, an increase of 25% from the prior target. Part of this capital return program was a special 70¢ dividend payout.

Conoco also lifted its capital expenditure budget for 2022 while not materially raising production targets. Spending was increased 8% to $7.8 billion against the prior target of $7.2 billion. This higher expenditure level was due to the inflationary pressure companies are experiencing in the U.S. At the same time, the company reduced its depreciation and depletion costs to $7.7 billion, reflecting the impact of revised production guidance.

Despite the strong year-to-date and one year stock price performance, we believe there is still an opportunity to invest in the company at current price levels. Conoco has roughly 30% of its business oriented to the natural gas sub-sector, and prices in that segment remain high by seasonal and historical standards. Furthermore, the Houston based energy producer has shown discipline on its cost structure and has sold off lower performing assets in the past at high valuations.

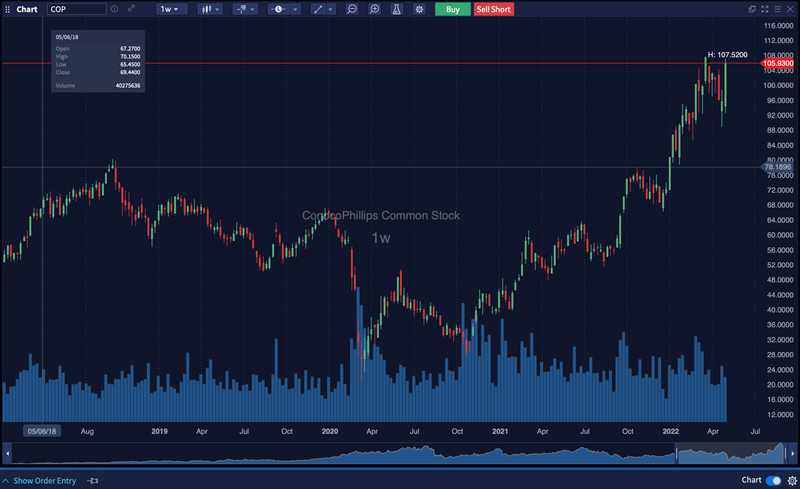

Over the past five years, Conoco has repositioned itself as a major player in the Permian basin while maintaining its balance sheet strength. Its cash flow was robust during the depths of the pandemic in 2020 and its disciplined expenditure history leads us to believe that the company can maintain outperformance relative to other companies in the sector. For example, since 2017, shares of the company have delivered a total return of 112.6% versus returns of 67.3% for the S&P 500, 36.5% for Exxon and 61.3% for Chevron. We believe this outperformance can continue for the foreseeable future.

Based on 14 Wall Street analysts offering 12 month price targets for Conocophillips in the last 3 months. The average price target is $128.92 with a high forecast of $160.00 and a low forecast of $115.00. The average price target represents a 20.72% change from the last price of $106.79.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.

Please check with your financial advisor to ensure that you are aware of the risks associated with your investment strategy and commission costs before placing your trades. You should consider your personal financial circumstances before engaging in any trading activity.

Volatility in the market, trade volumes, and system availability may delay your account access and trade executions. Be aware that the past performance of a particular security or strategy does not guarantee future results or success.